MORE INFORMATION

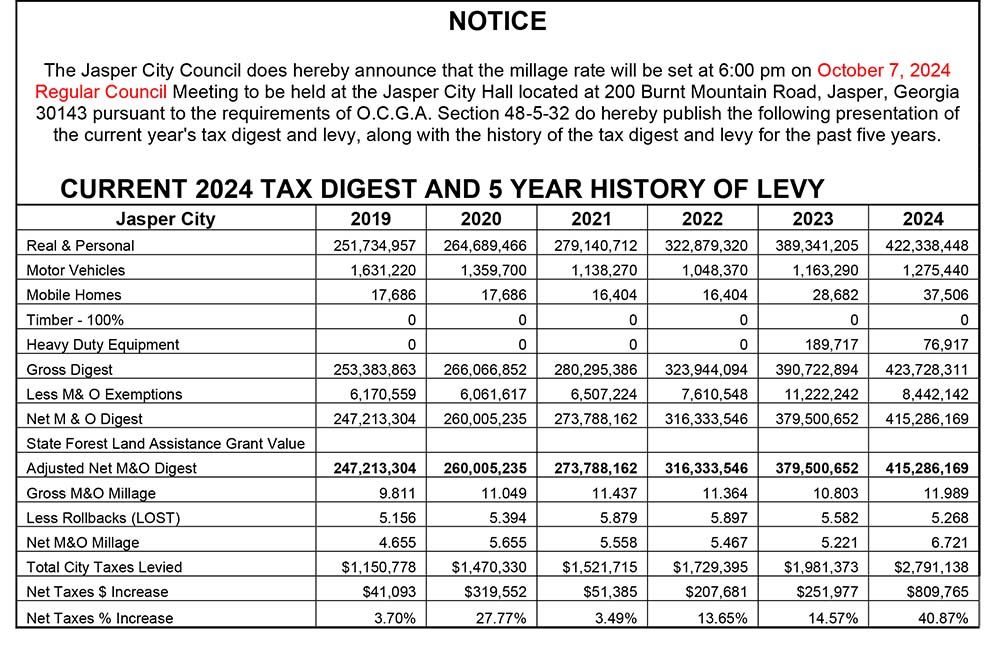

NOTICE OF PROPERTY TAX INCREASE CITY OF JASPER

The Council Members of the City of Jasper have tentatively adopted a millage rate which will require an increase in property taxes by 31.09 percent.

All concerned citizens are invited to Public Hearings on this tax increase to be held at Jasper City Hall, 200 Burnt Mountain Road, Jasper, GA 30143 on September 26, 2024, at an administrative hearing at 10:00 AM and 6:00 PM at a Special Called Meeting before the Mayor and Council in the Council Chambers.

An additional Public Hearing on this tax increase will be heard in the Council Chambers at Jasper City Hall, 200 Burnt Mountain Road, Jasper, GA 30143 on October 7, 2024, at 5:30 PM. Consideration and adoption of the millage rate will be heard subsequently at the Regular Meeting at 6:00 PM on October 7, 2024.

This tentative increase will result in a millage rate of 6.721 mills, an increase of 1.594 mills. Without this tentative tax increase, the millage rate will be no more than 5.127 mills. The proposed tax increase for a home with a fair market value of $175,000 is approximately $100.80 and the proposed tax increase for non-homestead property with a fair market value of $350,000 is approximately $210.00.

IMPORTANT ADDITIONAL INFORMATION

NOTICE TO TAXPAYERS CITY INCREASING MILLAGE RATE

According to Georgia law, all taxing agencies must advertise a tax increase and hold three public hearings to claim taxes on reassessed properties even if the millage rate remains unchanged. The City of Jasper has tentatively adopted a millage rate above last year's millage rate of 5.221. The tentative millage rate for 2024 is 6.721. This millage rate is 31.09% higher than the rollback millage rate of 5.127.